A summary from our Support for Seniors Webinar Series

On June 30, we were fortunate to partner with ATB Financial’s Fraud & CyberCrime Unit to present: Securing Your Money: Avoiding Common Scams, Frauds, & Cons under our Support for Seniors Series of webinars. Our presenter was Phil Palamattam, Senior Manager, Fraud & CyberCrime, ATB Business Risk. Our host organizer was Aisha Kritchlew, Senior Manager, Fraud & CyberCrime, ATB Business Risk.

This blog is a summary of this webinar including:

- a link to a recording of the presentation; (passcode: 5y!L3*Cq)

- a copy of ATB’s presentation slides; &

- a transcript of the Question & Answer portion immediately following the presentation.

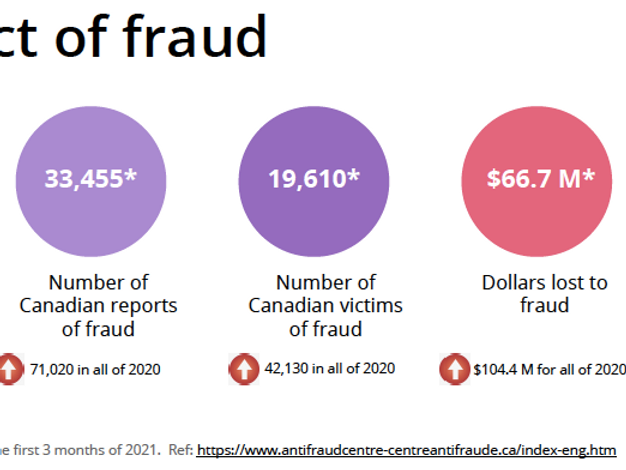

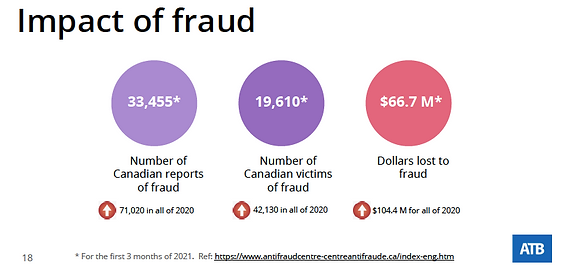

Knowledge and education are the best weapons to protect yourself and your funds and your financial institution can really be a great support and resource for many of us. The first step to protection is becoming aware of the current and emerging fraud threats, and educating yourself on how to keep your money secure while still continuing to engage cash based

services like lawn care and snow removal.

ATB discussed some of the safe and secure methods of paying for day to day services, and how to add an extra layer of protection for you or a loved one who may be vulnerable to financial abuse. They also shared some of the latest fraud scams and methods that fraudsters are using to attack you and get at your money along with ways your banking and personal information can be fraudulently obtained and used, and what to do if you fall victim to a fraud scam.

Question & Answers:

This is a summary of the questions that participants asked at the end of the presentation and were answered by the ATB team.

What happens when the senior is not computer literate and needs to pay for services such as lawn care, getting groceries?

A: The first thing to keep in mind, when dealing with a financial institution, is getting to know your bank’s relationship manager and talking to them about your financial needs. This may be the branch manager or someone else at the financial institution who provides ongoing customer service. If you don’t know who that is, just ask at your bank or call and explain your situation and what you’re hoping to do.

If it means you can’t do anything on a tech basis (ie. on the computer), you may have to set aside funds and manage things in a slightly different way but always talk to your relationship manager first to try and find a solution. That’s what they are there for.

What can be done when the person who has PoA (Power of Attorney) starts using your money on items not designated for you?

A: In this instance, you may need to contact law enforcement, talk with your relationship manager (at the bank) or legal representative to figure out what to do. It’s important to talk with someone quickly once you suspect or confirm this is happening.

SAIF recently did a webinar on PoA’s and other important documents in partnership with ECLC (Edmonton Community Legal Centre). Check out SAIF’s blog for a summary of that webinar and additional information on PoA’s, how to avoid their misuse, and what to do when there has been misuse.

What will happen if you delete a legitimate email from a financial institution or a real vendor? What if you make a mistake in judging a phishing email from a real one?

A: Be thankful you didn’t fall for a scam! If you think you made a mistake, reach out to your vendor or the financial institution relationship manager (do not use any contact information provided in an email) and explain the situation. They want to avoid having their customers be the victims of scams so they’re not going to look to penalize you for being careful.

Remember: financial institutions will not send you emails to seek information. They may send information via email but they’ll never ask you to verify your information through links or ask you to update your account information that way. When in doubt, contact your relationship manager at the bank.

My mom writes cheques to charities to make donations. Is that a bad idea?

A: No, this should not be an issue, but you do want to make sure a charity is legitimate. You can check with CRA by asking the charity for their registration number and then going to the CRA website to verify that charity is registered. If a charity declines giving your their CRA charitable number, that’s a red flag and you may want to proceed with caution.

Can you tell us about whether joint accounts are legitimate and what to do when funds are stolen from a joint account by the other account holder?

A: In general, a joint account has 2 owners but it may not always be clear which of the 2 is the owner of the funds. For most financial institutions, you can create 2 to sign or authenticate so that 1 person can’t take the funds out without the other one knowing. But if you don’t have 2 to sign or authenticate, then either party can take funds out and this wouldn’t be considered ‘stealing’ funds by either of the owners of the account.

You can restrict things and roles can be assigned to joint accounts and this is usually a good safety restriction to put in place if you are concerned about how the funds may be used by the other party or if you would like to ensure that monies cannot be withdrawn unless you both agree/approve the withdrawal.

We hope you can use this information to help better secure your money and avoid various instances of financial abuse that many people fall prey to every year. If you or someone you care about is dealing with the impacts of financial or economic abuse, please contact our Elder Abuse Response Coordinator at 780.460.2195 ext. 305 or email her at teresa@stopabuse.ca. Thank you.